Hi folks,

the french economist Thomas Piketty has just published a great book on " Capitalisme au 21' siècle",

the english version is due to come out this spring.

I have read the full 950 pages of the french version, with great delight, but do have a couple of comments that I did elaborate during and after. As usual, I did not agree with everything, worked on some of the formulas, did my own calculations and simulations, and hope that it might help to clarify our views.

You can find my short paper within the following link:

JCS Comments to T Piketty's Book

and the Resumé can be read right here:

A

few months ago, Thomas Piketty published a great book about Capital in our new

Century, and pointed out that the ratio of Capital to Revenue is growing again

and may soon reach levels not seen since the eve of WW1, that the share of

revenues that goes to capital is also reaching old heights again, that both

Capital and Revenue are distributed ever more inequally.

These

being trends of large concern to Mr Piketty, and not only him, his proposal is

to have both revenues and capital seriously taxed in progressive manners, in a

way that wealth, purchasing, decision, operation and political power are well

enough distrbuted to make revolutions and wars about these issues obsolete.

After

going though the book, I set out to have my own thoughts and calculations and

came up with the following facts and opinions, detailed in the following

chapters and summarized in the conclusions right here:

a)

I fully admire and appreciate the work that has gone

into Mr Piketty’s book, and agree that the growing inequality of distribution

of both revenue and capital is up to no good, and that the bulk of revenue

should really go to labor

b)

I also agree

that progressive taxation on both revenue and capital are needed to keep things

in check, and to avoid the concentration of large amounts of purchasing and

political power in the hands of the

few. These taxes should be organized on

a european, or better on a worldwide level

c)

I am not so sure about the inevitability of endless

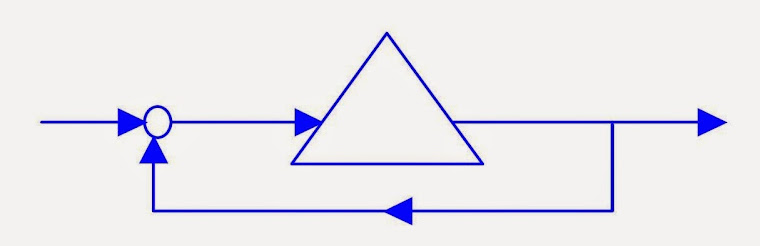

capital accumulation per se, as even in times of low growth, the formula B2 : BE’ = S% - BE * G% stands

for the limits thereof.

But

recession has to be avoided in that respect, as that will make things really go

haywire as the formula also shows.

d)

I also think that it is more relevant to consider the

inequality S% > G% ,

rather

than R% > G%, as it is savings that accumulate to capital.

e)

I am not sure either about what level of BE

Capital/Revenue ratio would be optimal for what purpose, so while it is

interesting to see how things have been through time, we should think about

what we would need or want, or dismiss it as an lesser variable.

That's it, follow the link if you want the details, comments are welcome at jcswork@pt.lu

cheers

Jean-Claude